Titano

Smart Contract Audit Report

Audit Summary

Titano is a new BEP20 token with an elastic supply and automatic LP adds.

Titano is a new BEP20 token with an elastic supply and automatic LP adds.

For this audit, we reviewed the Titano contract at 0xBA96731324dE188ebC1eD87ca74544dDEbC07D7f on the Binance Smart Chain Mainnet.

Audit Findings

Please ensure trust in the team prior to investing as they have substantial control in the ecosystem.

Date: November 10th, 2021.

Contract Overview

- The initial supply of 4 billion Titano is minted to the owner upon deployment.

- The maximum allowed supply of Titano is 340,282,366,920,938,463,463,374,607,431,768,211,455 tokens.

- Authorized addresses are able to mint any number of tokens up to the maximum supply.

- The owner may mint and burn a specified amount of tokens.

- There is a liquidity fee, a treasury fee, and a risk free value fee taken on buys with a sell fee taken in addition to other fees on sells.

- On deployment, fees are allocated as a 5% liquidity fee, 3% treasury fee, 5% risk free value fee, and 5% sell fee.

- Addresses on the whitelist are exempt from fees. The owner and the contract are set as fee exempt on deployment.

- Addresses on the blacklist are unable to transfer or receive tokens.

- During an initial distribution period, users are unable to transfer tokens unless they are on a separate "allow transfer" whitelist; presale addresses may receive tokens with no fees taken during this period.

- During transfers, if the contract's balance has met a threshold, the transfer is not a purchase, and the swapping functionality is enabled, a "swapback" will be performed.

- If the liquidity during the swapback is greater than the target value, initially 50% of the circulating supply, no liquidity will be added. Otherwise the liqudity fee is reserved for a liquidity add.

- A liquidity-add is funded by selling half of the tokens collected as liquidity fees, pairing the received BNB with the token, and adding it as liquidity to the BNB pair.

- The LP tokens received are sent to a specified Auto Liquidity Receiver address. We recommend that the team lock these LP tokens.

- The remaining contract balance is converted to BNB where subsequently the treasury fee is sent to the Treasury address and risk free value fee is sent to the Risk Free Value address.

- The owner may adjust the fees to any value, up to 100%, at any time.

- The owner may change the Treasury, Risk Free Value, and Auto Liquidity Receiver address at any time.

- The owner may add or remove an address from the blacklist, whitelist, and presale transfer whitelist at any time.

- The owner may end the initial distribution period at any time.

- The owner may change the LP pair address at any time.

- The owner may toggle swapback functionality at any time.

- The owner may change the target liquidity value and the contract threshold required to swapback at any time.

- The owner may add and remove an address as a valid minter at anytime.

- The owner may withdraw all BNB and ERC20 tokens in the contract at any time.

- Utilization of SafeMath to prevent overflow.

- The contract is BEP20 compliant; all standard functionality is present.

Audit Results

| Vulnerability Category | Notes | Result |

|---|---|---|

| Arbitrary Storage Write | N/A | PASS |

| Arbitrary Jump | N/A | PASS |

| Delegate Call to Untrusted Contract | N/A | PASS |

| Dependence on Predictable Variables | N/A | PASS |

| Deprecated Opcodes | N/A | PASS |

| Ether Thief | N/A | PASS |

| Exceptions | N/A | PASS |

| External Calls | N/A | PASS |

| Flash Loans | N/A | PASS |

| Integer Over/Underflow | N/A | PASS |

| Multiple Sends | N/A | PASS |

| Oracles | N/A | PASS |

| Suicide | N/A | PASS |

| State Change External Calls | N/A | PASS |

| Unchecked Retval | N/A | PASS |

| User Supplied Assertion | N/A | PASS |

| Critical Solidity Compiler | N/A | PASS |

| Overall Contract Safety | PASS |

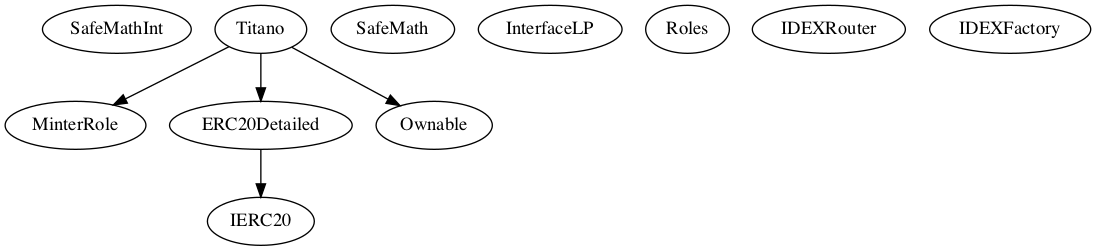

Inheritance Chart

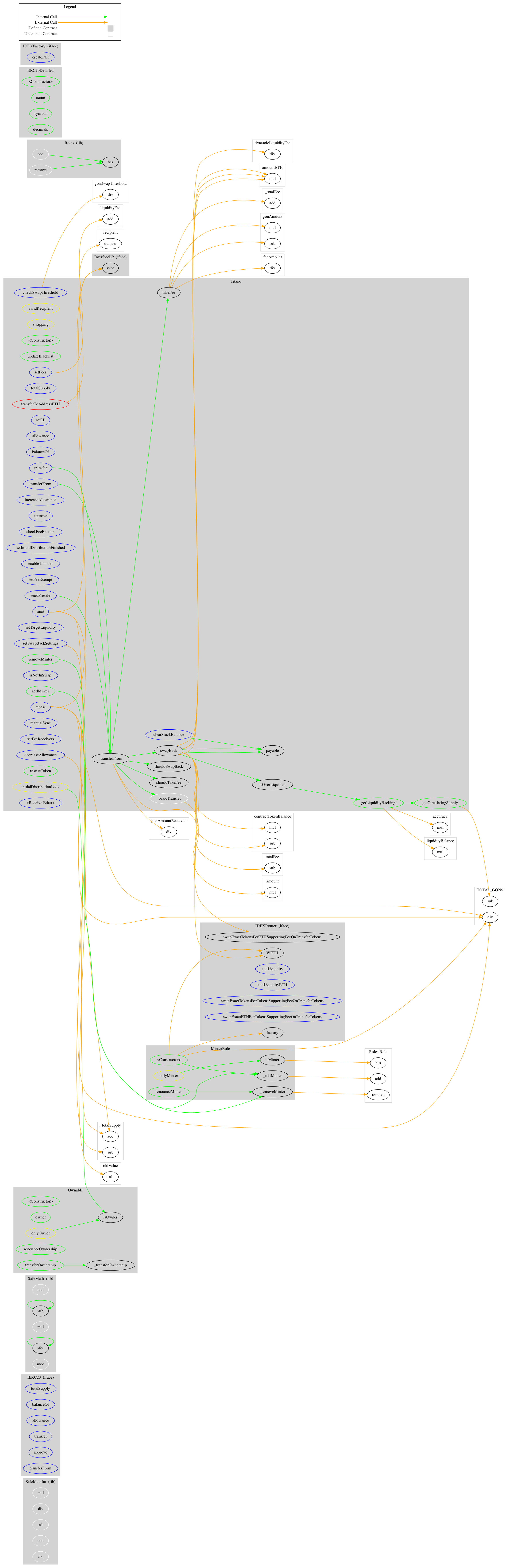

Function Graph

Functions Overview

($) = payable function

# = non-constant function

Int = Internal

Ext = External

Pub = Public

+ [Lib] SafeMathInt

- [Int] mul

- [Int] div

- [Int] sub

- [Int] add

- [Int] abs

+ [Int] IERC20

- [Ext] totalSupply

- [Ext] balanceOf

- [Ext] allowance

- [Ext] transfer #

- [Ext] approve #

- [Ext] transferFrom #

+ [Lib] SafeMath

- [Int] add

- [Int] sub

- [Int] sub

- [Int] mul

- [Int] div

- [Int] div

- [Int] mod

+ [Int] InterfaceLP

- [Ext] sync #

+ [Lib] Roles

- [Int] add #

- [Int] remove #

- [Int] has

+ MinterRole

- [Pub] Constructor #

- [Pub] isMinter

- [Pub] renounceMinter #

- [Int] _addMinter #

- [Int] _removeMinter #

+ ERC20Detailed (IERC20)

- [Pub] Constructor #

- [Pub] name

- [Pub] symbol

- [Pub] decimals

+ [Int] IDEXRouter

- [Ext] factory

- [Ext] WETH

- [Ext] addLiquidity #

- [Ext] addLiquidityETH ($)

- [Ext] swapExactTokensForTokensSupportingFeeOnTransferTokens #

- [Ext] swapExactETHForTokensSupportingFeeOnTransferTokens ($)

- [Ext] swapExactTokensForETHSupportingFeeOnTransferTokens #

+ [Int] IDEXFactory

- [Ext] createPair #

+ Ownable

- [Pub] Constructor #

- [Pub] owner

- [Pub] isOwner

- [Pub] renounceOwnership #

- modifiers: onlyOwner

- [Pub] transferOwnership #

- modifiers: onlyOwner

- [Int] _transferOwnership #

+ Titano (ERC20Detailed, Ownable, MinterRole)

- [Pub] Constructor #

- modifiers: ERC20Detailed

- [Pub] updateBlacklist #

- modifiers: onlyOwner

- [Ext] rebase #

- modifiers: onlyOwner

- [Ext] totalSupply

- [Ext] transfer #

- modifiers: validRecipient,initialDistributionLock

- [Ext] setLP #

- modifiers: onlyOwner

- [Ext] allowance

- [Ext] balanceOf

- [Int] _basicTransfer #

- [Int] _transferFrom #

- [Ext] transferFrom #

- modifiers: validRecipient

- [Int] swapBack #

- modifiers: swapping

- [Int] takeFee #

- [Ext] decreaseAllowance #

- modifiers: initialDistributionLock

- [Ext] increaseAllowance #

- modifiers: initialDistributionLock

- [Ext] approve #

- modifiers: initialDistributionLock

- [Ext] checkFeeExempt

- [Ext] setInitialDistributionFinished #

- modifiers: onlyOwner

- [Ext] enableTransfer #

- modifiers: onlyOwner

- [Ext] setFeeExempt #

- modifiers: onlyOwner

- [Int] shouldTakeFee

- [Ext] mint #

- modifiers: onlyMinter

- [Ext] setSwapBackSettings #

- modifiers: onlyOwner

- [Int] shouldSwapBack

- [Pub] getCirculatingSupply

- [Ext] setTargetLiquidity #

- modifiers: onlyOwner

- [Pub] addMinter #

- modifiers: onlyOwner

- [Pub] removeMinter #

- modifiers: onlyOwner

- [Ext] isNotInSwap

- [Ext] sendPresale #

- modifiers: onlyOwner

- [Ext] checkSwapThreshold

- [Ext] manualSync #

- [Ext] setFeeReceivers #

- modifiers: onlyOwner

- [Ext] setFees #

- modifiers: onlyOwner

- [Ext] clearStuckBalance #

- modifiers: onlyOwner

- [Pub] rescueToken #

- modifiers: onlyOwner

- [Prv] transferToAddressETH #

- [Pub] getLiquidityBacking

- [Pub] isOverLiquified

- [Ext] Fallback ($)About SourceHat

SourceHat has quickly grown to have one of the most experienced and well-equipped smart contract auditing teams in the industry. Our team has conducted 1800+ solidity smart contract audits covering all major project types and protocols, securing a total of over $50 billion U.S. dollars in on-chain value!

Our firm is well-reputed in the community and is trusted as a top smart contract auditing company for the review of solidity code, no matter how complex. Our team of experienced solidity smart contract auditors performs audits for tokens, NFTs, crowdsales, marketplaces, gambling games, financial protocols, and more!

Contact us today to get a free quote for a smart contract audit of your project!

What is a SourceHat Audit?

Typically, a smart contract audit is a comprehensive review process designed to discover logical errors, security vulnerabilities, and optimization opportunities within code. A SourceHat Audit takes this a step further by verifying economic logic to ensure the stability of smart contracts and highlighting privileged functionality to create a report that is easy to understand for developers and community members alike.

How Do I Interpret the Findings?

Each of our Findings will be labeled with a Severity level. We always recommend the team resolve High, Medium, and Low severity findings prior to deploying the code to the mainnet. Here is a breakdown on what each Severity level means for the project:

- High severity indicates that the issue puts a large number of users' funds at risk and has a high probability of exploitation, or the smart contract contains serious logical issues which can prevent the code from operating as intended.

- Medium severity issues are those which place at least some users' funds at risk and has a medium to high probability of exploitation.

- Low severity issues have a relatively minor risk association; these issues have a low probability of occurring or may have a minimal impact.

- Informational issues pose no immediate risk, but inform the project team of opportunities for gas optimizations and following smart contract security best practices.